BuddeComm's Research Reports

BuddeComm’s research database contains approximately 200 Research Reports covering over 180 countries, major companies, key technologies and market sectors. Our current research is supported by our extensive catalogue of over 4,000 archived Research Reports.

Immediate Delivery

Access your PDF report immediately using our secure online payments. We have various purchase options available.

Essential Data and Analyses

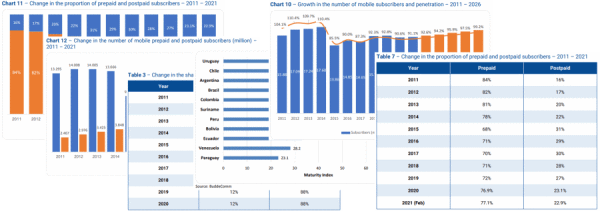

Our reports include analyses from our senior researchers and the latest data available from BuddeComm utilisiing data from the ITU and regulators, with key information presented in tables and charts.

Research Methodology

BuddeComm's strategic business reports contain a combination of both primary and secondary research statistics, analyses written by our senior analysts supported by a network of experts, industry contacts and researchers from around the world as well as our own scenario forecasts.

For more information on our research methodology including: sources, parameters and approach to forecasting, please see: BuddeComm's Research Methodology

TMT Intelligence

A platform to scale your intelligence tasks

Monitor critical insights with our AI-powered Market Intelligence Platform gathering and analyzing intelligence in real time. With AI trained to spot emerging trends and detect new strategic opportunities, our clients use TMT Intelligence to accelerate their growth.

If you want to know more about it, please see:

Research Methodology

BuddeComm's strategic business reports contain a combination of both primary and secondary research statistics, analyses written by our senior analysts supported by a network of experts, industry contacts and researchers from around the world as well as our own scenario forecasts.

For more details, please see:

More than 4,000 customers from 140 countries utilise BuddeComm Research

Are you interested in BuddeComm's Custom Research Service?

Contact us

Research

Hot Topics

News & Views

Have the latest telecommunications industry news delivered to your inbox by subscribing to BuddeComm's weekly newsletter.